A tax is a tax is a tax.

Videos by Rare

Heavy taxation of corporations is a tax that garners much public support. After all, who better to tax than greedy corporations that outsource Americans jobs, employ sweatshop labor, “sit on piles of cash,” and pay their executives exorbitant amounts?

Given how most people think of corporations, it isn’t hard to understand why people see them as a preferable target to tax.

Yet the idea of abolishing the corporate income tax is becoming more popular across a relatively diverse group of publications, including the New York Times, Forbes, Bloomberg, and The Economist. Why is this?

The corporate income tax is one issue that produces near unanimous agreement among economists. In a NPR article summarizes six issues that economists favor which the public do not, they stated on corporate taxation: “Eliminate the corporate income tax. Completely. If companies reinvest the money into their businesses, that’s good. Don’t tax companies in an effort to tax rich people.”

To understand the logic behind this sort of thinking, as yourself the question: “who pays the corporate income tax?” A tax on gasoline isn’t paid for by ExonMobile, it’s paid for by the consumer at the pump. A tax on property isn’t paid by your property – it’s paid by the homeowner.

A corporation is a legal entity composed of individuals. Like every tax, it’s paid for by individuals. And the individual that pays the most isn’t some greedy CEO – it’s the worker and the consumer.

Raise a corporation’s tax burden by a dollar and they reduce their employees pay or increase their prices to offset it. There are various estimates on the extent to which workers bear the burden of the corporate tax. In a post at Liberty.me, my co-author Corey Iacono summarized the results of numerous studies, bulleted below:

- According to economists from the University of Oxford and Rutgers, “our estimates suggest that a one dollar increase in corporate tax revenue decreases wages by around 60 cents.”

- Economists from the Federal Reserve bank of Kansas find that, “a one-percentage-point increase in the marginal state corporate tax rate reduces wages 0.14 to 0.36 percent.”

- According to economist Alison Fenix, “I estimate that a one percentage point increase in the marginal corporate tax rate decreases annual wages by 0.7 percent.”

- Economists James Hines and Alison Fenix analyze the effect of corporate taxation on the wages of union members and find that, “a one percent lower state tax rate is associated with a 0.36 percent higher union wage premium.”

- A study produced by three economists from the University of Warwick states, “[Our results imply] that an exogenous rise of $1 in [corporate] tax would reduce the wage bill by 49 cents.”

Case in point: look at a country like Norway, where oil profits are taxed at an astronomical 78%. Despite being oil rich, Norway has the most expensive gasoline in the world at over $10 a gallon.

In light of this data, we can be confident that reducing or eliminating the corporate tax would benefit more than just corporations. The National Bureau of Economic Research estimates that an abolition of the corporate tax would raise the wages or workers by 12-13%.

The corporate tax isn’t just a single tax. One consequence of the corporate tax is that of double taxation. In other words, a corporation pays tax on their profits before they can distribute dividends to their shareholders, who will then be taxed on those dividends.

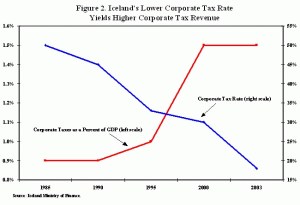

Even for someone who finds abolishing the corporate tax too radical a position to hold, there would still be huge benefits from seriously reducing it. Countries with lower corporate taxes tend to attract more business, which can bring in a lot more revenue.

For instance, click on this chart of Ireland’s corporate tax rate and the amount of revenue brought in when they lowered it, and then wonder why in the world the U.S. government does not follow suit: