Economic growth goes sharply down, while stocks go sharply up. Welcome to Obamanomics.

Videos by Rare

On Wednesday the Commerce Department released a gloomy revised report on the first quarter of 2013. Gross domestic product (GDP) growth was revised down to 1.8% from the original 2.4%. Consumer spending, estimated at 3.4%, turned out to be 2.6% Every category sank with the exception of home construction and government spending, the latter of which was mostly pre-sequestration.

Bad news, right? Not to the stock market. Broad markets closed up almost 1% Wednesday after suffering a slump late last week. You would think that a weaker-than-believed economy would make investors wary. But that only makes intuitive sense in free market economies, not in the Fed-fuelled bizarro-world we currently live in.

The Federal Reserve has been helping underwrite the bull market by buying $85 billion in bonds every month as part of its quantitative easing program. But last week Fed Chairman Ben Bernanke said the party was about to end. The Fed was going to start easing back on the bond buying program, wrapping it up in mid-2014. The idea was that as the economy got stronger, there would be less need for the Fed’s crutch.

But economic growth is fickle, and quantitative easing is predictable. With increased risk on the horizon, stock markets declined and bond yields rose. However this week’s bad economic news undercut the Fed’s rationale to pull back. So stocks could resume their climb, with investors secure in the knowledge that the economy was bad enough for the good times to keep rolling.

More good — or is it bad? — news: rising interest rates will help snuff out the rising home construction sector, meaning even more incentive for the Fed to keep priming the pump. And once the full impact of the Federal budget sequester hits the already sagging GDP, things will look so grim that stocks could go through the roof.

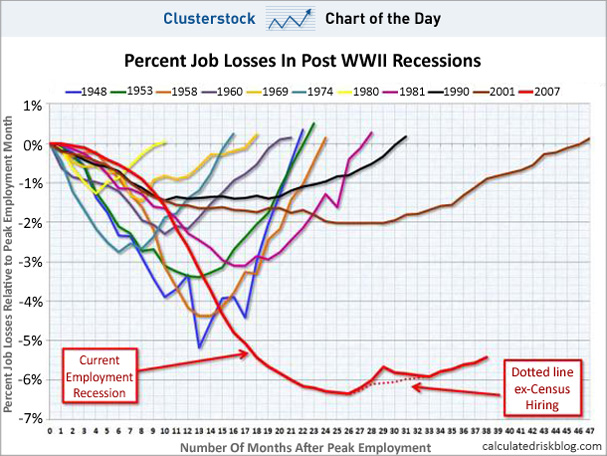

Investors – at least in some respects – are rational actors. They know that in the long run President Obama’s economic policies are leading to disaster. A country increasingly in debt, with declining growth rates and soaring numbers on food stamps, is not heading for prosperity. But the big collapse is not here yet, and Wall Street can make hay while the sun shines. Investors can root for bad second-quarter GDP news, and they will probably get it. The Obamacare train wreck, growing regulation of the energy sector, and the general cluelessness in the White House over how wealth is created, all point towards a dismal future. At some point the debt-driven house of cards will collapse, probably (like last time) due to a crisis sparked by rising interest rates. And that will be when the bad news finally turns bad.

James S. Robbins is Deputy Editor of Rare and author of Native Americans: Patriotism, Exceptionalism, and the New American Identity. Follow him on Twitter @James_Robbins