When I was college shopping back in 2004, the idea of “tuition inflation” wasn’t on my—or most people’s—radar. We knew that college was expensive, of course, but I don’t remember my classmates or our parents thinking there was anything to be done about it other than working hard and, in most cases, taking out massive loans.

Videos by Rare

For me, however, loans were always off the table. My main criteria when looking at schools was that I’d be able to graduate debt-free. Given that my family isn’t named Rockefeller, that wasn’t an easy task.

So I went to the less prestigious choice of schools, which gave me a full ride scholarship. I worked long hours over the summers and took extra classes so I could finish a year early.

When I graduated, I didn’t owe a single dime. It was all worth it.

Most of my generation is not so fortunate.

As proud as I am about what I accomplished, my path simply isn’t available to most people. The scholarship I recieved, for instance, was only given to ten students each year, about 0.3% of my graduating class.

And my alma mater? Its tuition now runs more than $30,000 annually, which is a 50% increase in the last six years alone.

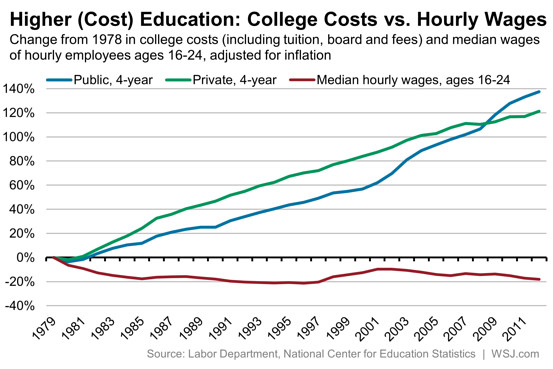

And don’t even think about paying that kind of bill with a summer job. Fewer and fewer college students are working their way through school now because it’s just not possible to make tuition payments with low wage jobs anymore.

In 1979, it took only one 8-hour day of minimum wage work to pay for a single credit hour of in-state tuition at a public university. Now, it takes 60 hours—a week and a half if you’re working full time, which is unrealistic for many students.

And if you want to attend a private institution? Tough luck, kid. Expect 120 to 180 hours of work to pay for a single credit hour.

But don’t forget, you need 15 of those credit hours every single semester to graduate on time. Even at public university rates, that’s 22.5 weeks of full-time work to cover a semester’s tuition, even though semesters are only about 15 weeks long.

And that’s not even scratching the surface of costs for room and board, books, and spending money.

With these numbers, pulling yourself up by your own bootstraps can’t work. College is just too expensive. Tuition has skyrocketed far faster than the average rate of inflation—1200% in the last three decades—and even the rising costs of health care can’t keep up.

Faced with these absurd prices, students are taking on even more loans. The average 2014 graduate has a crushing $33,000 of student loan debt.

To remedy all this, President Obama introduced this year his student loan forgiveness plan. The idea is that you’ll only pay 10% of your discretionary income on your student loan bills for 20 years after graduation (or only 10 years if you work for the government or a nonprofit). Then, at the 20-year mark, everything you still owe is instantly forgiven, though you can expect a nasty tax bill that year.

As much as this might sound attractive to those struggling to stay ahead of their debt payments, in the long run, it will only make matters worse. That’s because tuition rates don’t magically inflate on their own.

There’s a reason college costs so much. The reason is government.

How does this work? It’s a simple process of well-disguised good intentions.

First, there still exists a societal premise we should send as many students to college as possible. Never mind that this is blatantly untrue. For many, it makes more sense to skip a bachelor’s degree in favor of trade school, entrepreneurship, or just heading straight to work.

Sending people to college who don’t want or need it does no one any favors.

True to its busybody form, the government must get itself involved in this nonsensical but allegedly inspirational project. So Washington, DC offers loans and other assistance programs which ostensibly will put a college education within everybody’s reach.

The goal sounds noble. The result has been disastrous.

Empirical evidence shows that government subsidization of higher education drives prices up—way up. Colleges respond to this easy money guaranteed by tax-dollars by jacking up their prices well above what families could afford to pay on their own, and spending the resulting cash with abandon.

Simply put: The more government interferes, the more tuition rates jump. The more tuition rates jump, the more government interferes.

The student loan forgiveness program will only exacerbate this problem by encouraging more borrowing and thus higher tuition than ever. And, of course, both Washington and Wall Street turn a profit through the whole process, bilking taxpayers and beleaguered students alike.

So yes, college is too expensive—but added government interference is more expensive still.

It’s time we kicked Washington off the quad.