As prices skyrocket across the United States, the list of affordable places one can reasonably rent, let alone buy, grows smaller. Even with an uptick in housing construction and a rebounding economy, it seems that the price of housing keeps rising while wages plateau across the country. The demand for affordable apartments is simply outpacing the market and renters are seeing those results first-hand. The National Low Income Housing Coalition, established in 1974, released its 2020 report titled, “Out of Reach: The High Cost of Housing” pointing out these differences.

Videos by Rare

In 2016, the National Low Income Housing Coalition went viral with its report on the hourly wage one needed to earn to reasonably afford a 2-bedroom apartment rental in each state. The changes from 2016 to 2021 are evident. Before we dive into the data, though, here’s how the National Low Income Housing Coalition determined their numbers, per the 2020 report:

The report’s Housing Wage is an estimate of the hourly wage full-time workers must earn to afford a rental home at HUD’s fair market rent without spending more than 30% of their incomes. Fair market rents are estimates of what a family moving today can expect to pay for a modestly priced rental home in a given area. The kind of home that can be rented for the fair market rent is in decent condition, but it is not luxury housing.

You might expect that the rent in places like Los Angeles, San Francisco, San Diego, and Chicago will continue to rise over time, but the most shocking fact is this. Right now in America, there is no county in any state where a person can earn the federal minimum wage, work a standard 40-hour week, and still afford a modest 2-bedroom rental at fair market rent. That’s not just for U.S. cities or metropolitan areas, either. That is indeed for the entire country.

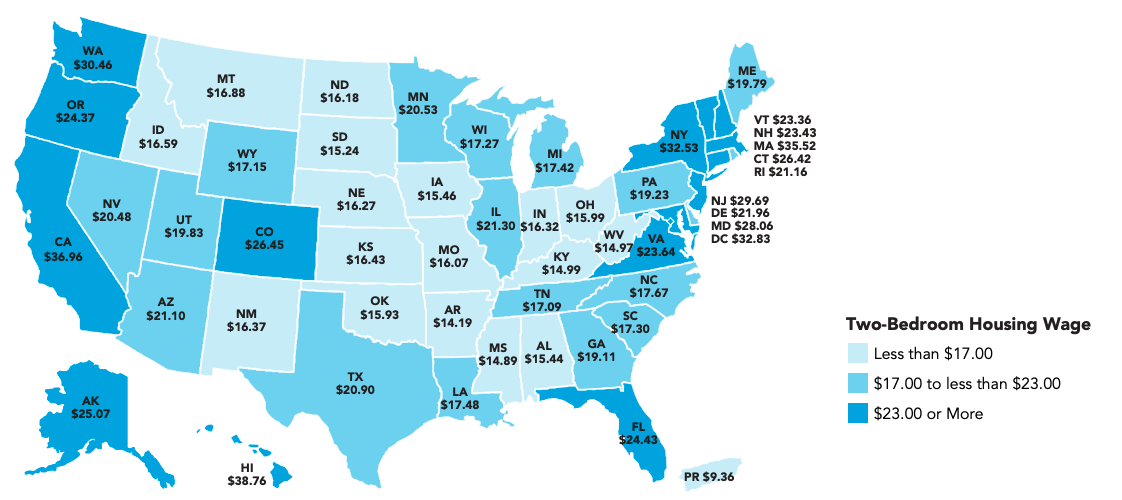

Here’s a breakdown of what a person must earn per hour to afford a modest two-bedroom apartment in each state, based on current rental prices and the real estate market.

The Hourly Salary Needed in 2021 to Afford a 2-Bedroom Rental in Each State

- Alabama: $15.44

- Alaska: $25.07

- Arizona: $21.10

- Arkansas: $14.19

- California: $36.96

- Colorado: $26.45

- Connecticut: $26.43

- Delaware: $21.96

- Florida: $24.43

- Georgia: $19.11

- Hawaii: $38.76

- Idaho: $16.59

- Illinois: $21.30

- Indiana: $16.32

- Iowa: $15.46

- Kansas: $16.43

- Kentucky: $14.99

- Louisiana: $17.48

- Maine: $19.79

- Maryland: $28.06

- Massachusetts: $35.52

- Michigan: $17.42

- Minnesota: $20.53

- Mississippi: $14.89

- Missouri: $16.07

- Montana: $16.88

- Nebraska: $16.27

- Nevada: $20.48

- New Hampshire: $23.43

- New Jersey: $29.69

- New Mexico: $16.37

- New York: $32.53

- North Carolina: $17.67

- North Dakota: $16.18

- Ohio: $15.99

- Oklahoma: $15.93

- Oregon: $24.37

- Pennsylvania: $19.23

- Rhode Island: $21.16

- South Carolina: $17.30

- South Dakota: $15.24

- Tennessee: $17.09

- Texas: $20.90

- Utah: $19.83

- Vermont: $23.36

- Virginia: $23.64

- Washington: $30.46

- West Virginia: $14.97

- Wisconsin: $17.27

- Wyoming: $17.15

The current Federal Minimum Wage is $7.25 per hour; it hasn’t been raised in over a decade. Per the report, the 2020 National Housing Wage is $23.96 for a two-bedroom rental home and $19.56 for a modest one-bedroom rental home. Note that these are not median rents, and instead are based on the idea of Fair Market Rent, or the 40th percentile of gross rents for standard rentals. As the National Low Income Housing Coalition points out, “, the average minimum wage worker must work nearly 97 hours per week (more than two full-time jobs) to afford a two-bedroom rental home or 79 hours per week (almost exactly two full-time jobs) to afford a one-bedroom rental home at the fair market rent.”

This steady uptick in housing prices and the stagnant wage rate created an ever-expanding gap that simply asks so much from American families trying to maintain a certain standard of living, at the minimum wage level or otherwise. Major metropolitan areas and expensive cities aside, the list of affordable cities where both millennials and baby boomers can enjoy a healthy work-life balance is growing smaller and smaller. While the Midwestern cities of the Heartland once offered this, places like Milwaukee, Louisville, Columbus, Toledo, and Kansas City are even seeing major changes in their housing and rental markets for one-bedroom apartments, two-bedroom apartments, and more.

Have you personally experienced this struggle in the search for affordable living lately in the U.S.? If so, let us know in the comments because we’d love to hear your story and learn more.

This article was originally published on June 14, 2018. It was updated on April 23, 2021, to show the hourly salary needed in 2021