Robinhood has announced it will allow users to lend out their shares of stock in an effort to diversify the company’s revenue.

Videos by Rare

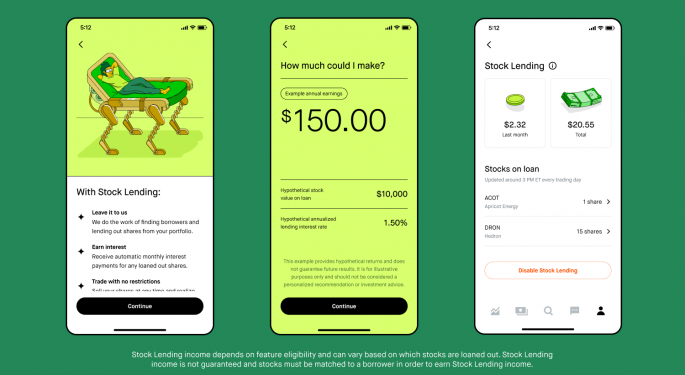

On Wednesday the company announced Stock Lending, a program through which users can earn passive recurring income from their shares of stock. The feature allows users to earn income on the stocks they own by lending out their shares. The trading platform says the feature is currently being rolled out and will be available to all customers by the end of the month.

Users can still sell shares on loan whenever they want. Stock lenders may lose the right to vote when lending shares, and Robinhood said they will receive cash payments in lieu of dividends.

“We’re excited to break down yet another barrier and democratize a product that has been historically preserved for the wealthy with high barriers to entry,” said Steve Quirk, Robinhood’s chief brokerage officer.

Customers won’t have to carry any minimum balance in their account in order to participate, which tends to be the norm at other exchanges that allow them to lend out their shares. As long as the shares have been fully paid for by the customer, Robinhood says it will match customers with interested borrowers to take the loans and that customers will get paid once their shares are successfully placed.

In a blog post, Robinhood said financial institutions borrow shares of stock for “many reasons, including to cover deficits, failed deliveries, collateral, or to cover short sales.”

Robinhood makes nearly three-quarters of its revenue from transactions, and that revenue stream has been falling steadily since last year as trading activity has cooled. The new lending feature is an attempt by the company to diversify its revenue streams, as it will take a cut of the fees from each loan.

The company already makes money by lending out shares to customers who buy them “on margin,” and this new stock lending program is expected to bring in one-to-two times the revenue of the existing margin lending offering, CFO Jason Warnick said on the company’s earnings call last week.

Robinhood was at the center of the meme stock craze in 2021 when groups of retail traders on Reddit’s WallStreetBets and other social media platforms orchestrated targeted buying campaigns in GameStop Corp., AMC Entertainment Holdings Inc AMC, and other heavily shorted stocks in an attempt to punish short sellers. Robinhood subsequently dealt with a number of lawsuits when it temporarily restricted buying in GameStop and other meme stocks.

Now Robinhood is offering its users a chance to lend their shares out to those very same short sellers many of its users were targeting just a year ago.

Robinhood recently reported a 43% drop in revenue in the first quarter, and its stock has fallen 73.2% in the last six months.

Photo by Joshua Mayo on Unsplash

Trading robots for spot and futures exchanges. The best bots for trading in the cryptocurrency market. Smart algorithms based on technical analysis for trading at all market stages. Robots have a risk management system. Demo and real trading available.