Today, Apple was forced to appear in front of a Senate hearing and was in a position of defending their business decisions, despite doing nothing wrong at all. Tax avoidance is not tax evasion, and the panel decided that what Apple did wasn’t actually illegal.

Videos By Rare

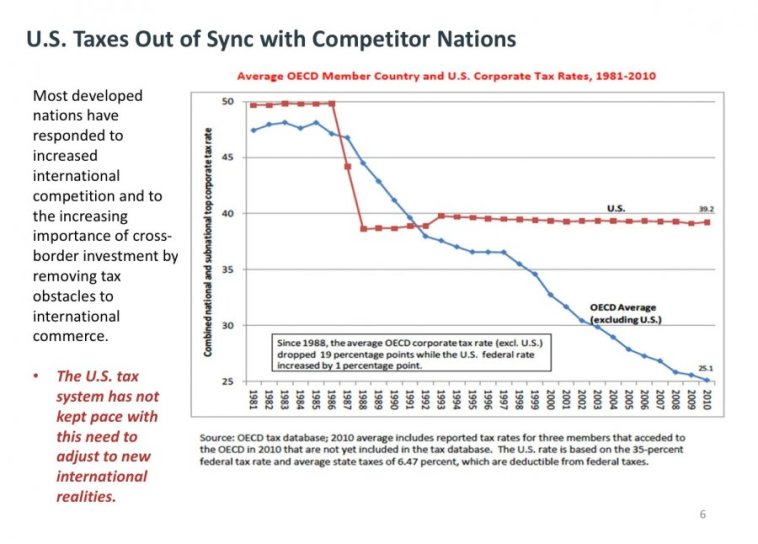

The problem here is not the corporations. The problem here is the U.S. tax code, which is becoming increasingly hostile to business. Any semi-successful businessman understands that you cut costs where you can. If almost half of your income is being shelled out in taxes, it’s time to reevaluate, which is exactly what many are starting to do.

As the U.S. tax code leviathan works to destroy business and entrepreneurship, business owners and CEOs are forced to take operations elsewhere. Here are some recent examples of companies driven off-shore to more tax friendly environments.

1. Actavis announced this week that they’ll head to Ireland, despite head execs living in New Jersey.

Drugmaker Actavis (ACT) announced yesterday that it will buy rival Warner Chilcott PLC for $5 billion in stock and that, as part of the deal, it plans to reincorporate itself in tax-friendly Ireland, where Warner Chilcott (WCRX) is based. This despite the fact that the company’s top executives, including CEO Paul Bisaro, will continue to live and work in New Jersey.

2. Apple takes their business all over the world, cites paying “extraordinary amount” in U.S. taxes.

The Senate’s Permanent Subcommittee on Investigations is expected to release findings Tuesday claiming Apple didn’t pay taxes on at least $74 billion in overseas income. In response, Apple has released a statement explaining that the U.S. tax system “has not kept pace with the advent of the digital age and rapidly changing global economy” and that the company has paid “an extraordinary amount in U.S. taxes.”

The Senate contends that Apple set up subsidiaries in other countries for which it paid no taxes to any government. However, Apple says the units were not designed to avoid taxes, but because the company sells the majority — 61% — of its products outside the U.S. The subcommittee is looking especially at Apple’s Cork, Ireland, subsidiary from which it runs its European, African, Middle Eastern, Indian and Asian operations. Apple claims it pays local taxes on overseas earnings and pays U.S. taxes on income from its Irish units.

Apple’s job creating machine extends across the United States. The iPhone uses Gorilla Glass, which is manufactured in Kentucky by Corning. Today, Corning—and Kentucky—benefit from nearly $700 million in sales, employing more than 300 people thanks to Apple. Rather than berating Apple, we should celebrate the jobs Apple continues to create.

3. EatonCorps left Ohio for Ireland last year.

EatonCorp’s purchase of electrical equipment maker Cooper Industries means another U.S. company will soon leave the United States in favor of relocating its headquarters to a foreign country with sharply lower taxes.

In the case of diversified industrial manufacturer Eaton (ETN.N), a complicated corporate structure will allow it to become part of an Irish corporation and enjoy that country’s low 12.5 percent corporate tax rate.

The top U.S. corporate tax rate is 35 percent, the highest in the world.

We’re noticing a pattern with the Ireland thing. Why WOULDN’T companies leave the U.S. if they can pay 1/3 the taxes in Ireland? It’s a smart business decision.

4. Aon leaves homegrown Chicago HQ for London

Chicago will lose the headquarters of one of its biggest and most high-profile companies later this year when Aon Corp. moves its home office from its namesake skyscraper to London, partly to lower its tax burden.

They did say they were going to keep employing the majority of their Chicago based staff, but there’s a big morale hit that occurs when a company that grew out of a city leaves. Let’s face it, Chicago has enough of a morale problem. Making the city more business friendly would work wonders.

5. Ensco bailed in response to the moratorium on offshore drilling.

Offshore drilling company Ensco moved to the U.K., and since the move, the company said its effective tax rate has fallen from 19% in 2009 to 10.5% during the second quarter of 2012.

6. Honeywell International Inc. just started investing in foreign entities to fuel foreign sales. Also, to avoid “anachronistic” U.S. taxes.

Honeywell International Inc. boosted its store of untaxed earnings held by its offshore subsidiaries and earmarked for foreign investment by $3.5 billion last year to $11.6 billion, a rise equal to the industrial conglomerate’s annual profit, excluding a pension adjustment. The company said the increase resulted from $2.1 billion of pretax earnings from its foreign subsidiaries and changes in estimates.

Chief Financial Officer Dave Anderson says Honeywell needs to invest outside the U.S. to fuel foreign sales, which accounted for 54% of Honeywell’s revenue last year.

He also says the tax code is part of the equation. “The anachronistic tax system that we have penalizes companies for their success outside of the U.S.,” Mr. Anderson says.

7. Microsoft did exactly the same thing that Apple did. Also not illegal.

Software maker Microsoft Corp. boosted the holdings of its foreign subsidiaries by $16 billion in the fiscal year ended June 30, 2012, to $60.8 billion….The growth in Microsoft’s overseas holdings nearly equaled its net income for the year of $17 billion—in part because Microsoft said its foreign operations accounted for 93% of its pretax profit last year.

In its report, the Senate committee said Microsoft had shifted intellectual property to subsidiaries in Singapore, Ireland and Puerto Rico, to avoid roughly $4 billion in U.S. taxes in 2011. Licensing rights, and revenue, sometimes traveled through more than one subsidiary to minimize the tax bill.