While President Obama and his Democratic friends have us all riled up about inequality, an effort to distract the American people from the Obamacare disaster, let us take a look at lives of the rich and famous 1 percent.

Videos by Rare

Let’s compare the income of the 1 percent to their income taxes.

For some time, I’ve had a page on income tax history at usgovernmentrevenue.com, the evil spawn of usgovernmentspending.com. It had a handy chart of income and taxes for the 1 percent from 1986 through 2009. It was based on a spreadsheet published by the Internal Revenue Service.

Unfortunately, the IRS hasn’t updated the 1986-2009 data. Instead, the agency started a new spreadsheet, featuring income and income tax from 2001-2011 and a slightly different definition of income. That’s a real pain, because I’d like to keep using the 1986 data on my chart, and for several months I’ve been flummoxed about what to do. Then I had an idea: why not mash the two data series together? So I did.

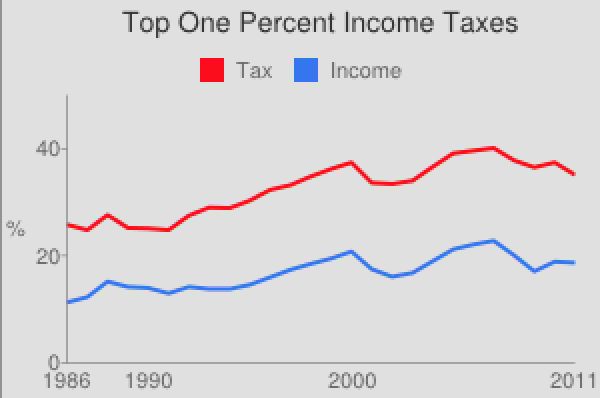

Now, nobody is interested in the average American. What we want to know is what the rich are doing. Here is a chart of income and federal income tax for the 1 percent from 1986 to 2011:

Allow me to give you the numbers. Back in 1986, when the Gipper ruled the earth, the top 1 percent reported 11.8 percent of the total income reported to the IRS and paid 25.8 percent of the federal income tax. By 2007 at the top of the real-estate bubble, the top 1 percent earned 22.8 percent of income and paid 40.8 percent of income tax.

You can see why I wanted to keep the data going back to 1986. It shows the 1 percent going gangbusters during the Clinton years.

President Obama thinks the rich should pay a little more. How much is a “little” Mr. President?

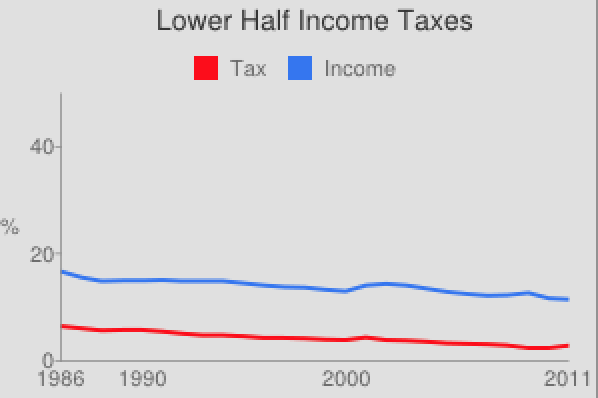

But what about the rest of us? Here’s the same chart for the bottom 50 percent of taxpayers reporting income to the IRS.

For the lower half, or Mitt Romney’s 47 percent, things are not so good. It’s down, down, down all the way. But at least their taxes have been going down too.

Notice how the rich pay less during recessions and the poor pay more. Why is that?

Are the 1 percent taking too much of the nation’s income? Are they paying their fair share of the nation’s taxes? One thing to remember is that the 1 percent is not a caste sitting on top of the nation’s income structure, not like the “Cathedral” sitting on top of the nation’s education and media. As Thomas Sowell keeps pointing out, the 1 percent continues to change from year to year.

The turnover of people is substantial in all [income] brackets — and is huge in the top 1 percent. Most people in that bracket are there for only one year in a decade.

That’s because the top 1 percent doesn’t make its money like Ralph Nickleby or Ebenezer Scrooge by operating the 19th century equivalent of a check-cashing store. Nor does it make its money by ripping off college students using the government’s student loan system. It gets its payoff from making extraordinary products and services that people want to buy.

As it says on the wall at my local Whole Foods Market, John Mackey, proprietor: “We create wealth with profits and growth” selling the kind of products that gentry liberals want to buy.

Way to go, John. I hope you get to stay in the 1 percent.