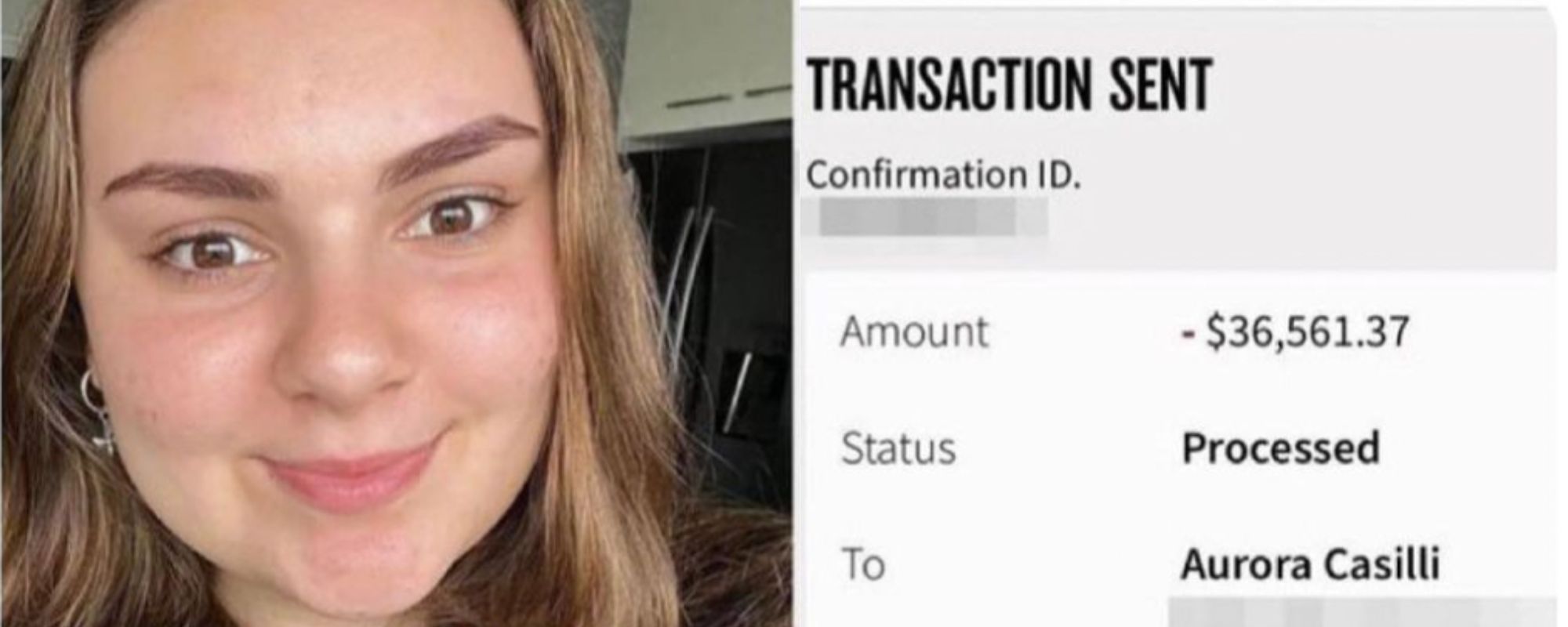

A teenage girl from Western Australia has lost her entire hard-earned savings after falling victim to a phone scam. Aurora Casilli, 18, says the scam involved criminals who were “spoofing” her bank’s contact information. She didn’t know what was happening until after she’d transferred $36,561, equivalent to about $25,000 US dollars. It was every penny she had.

Videos by Rare

18-Year-Old Aurora Casilli Lost Her Life Savings When a Scammer Contacted Her Through Her Bank’s Text Messages

Aurora Casilli told the news that she’d been saving her money for a down payment on a house. At times, the teen worked 3 jobs. While her peers were making frivolous purchases, she was tucking it all away.

Then Casilli received a text message from the same number and text conversation thread as her bank, the National Australia Bank (NAB). She was informed that someone had hacked into her account and was trying to steal her money.

“The text was from NAB, (National Australia Bank) and was underneath others messages I got from them. It seemed legit to me, so I called the number in a panic,” said Casilli. “If it was from a random mobile number, I wouldn’t have believed it. But it seemed so real.”

When Aurora Casilli called the 1-800 number given to her in the text thread. She said she heard the “same NAB ringtone, wait times and even the same customer service options,” as any regular call to her bank. She spoke to a man with a British accent, who prompted her to protect her money by transferring it into a new account. As soon as she did so, he hung up on her.

That’s when Casilli realized that the new account was associated with the Commonwealth Bank — not the NAB.

Casilli Hasn’t Gotten Her $25,000 Back

Aurora Casilli says she immediately tried to contact her bank but NAB said there was nothing she could do. And the Commonwealth Bank flagged the scammer’s account, but it was too late. All the funds had been taken out.

Worse, because Aurora made the transaction on her own volition, the NAB said that she was “not a victim of a scam.” The bank offered her $2,000 but she refused it.

“That money was for my first home deposit or for me to start studying at university and move but now I have lost everything,” Casilli said. “I’ve done everything I can possibly do, but I want to keep fighting and I don’t want the bank to shut me off.”

Spoofing & Phishing Can Occur In Numerous Ways

Spoofing is a sophisticated form of phishing that can mimic a real person or organization’s phone number or sender ID. It can be used for ingoing and outgoing communications. The victim is then lured in and tricked into giving something, like money.

Take this as a warning. If you’re ever faced with a random, urgent message involving your finances, don’t respond. Hang up and contact your bank via the number on your card.